Information security, the mantra of every hacker, is an oxymoron. It is increasingly difficult to protect against hacking and the unauthorized use of information. As the pandemic continues to hold the spotlight, the technocratic elite move to expedite a global reset, pushing humanity's dependence upon all things digital, including a global digital currency, and, if they have their way, digital passports. Meanwhile, cyberattacks are picking up speed around the world, along with warnings highlighting past and current attacks. But yet, despite the ever-increasing wealth of information at our fingertips, we don't really know who is behind them.

Paying attention to the messages, there is little doubt that future cyberattacks and catastrophes are on the horizon, with the potential to stop life as we know it in its tracks. With the billionaire elites and a handful of big corporations dominating every aspect of our lives, being properly informed is a fundamental first step in protecting our freedom.

“We all know, but still pay insufficient attention, to the frightening scenario of a comprehensive cyber attack which would bring a complete halt to the power supply, transportation, hospital services, our society as a whole. The COVID-19 crisis would be seen in this respect as a small disturbance in comparison to a major cyberattack." ~Klaus Schwab

COVID-19, the World Economic Forum, and the Great Reset

In 2014, World Economic Forum (WEF) founder Klaus Schwab called for a "Great Reset"— essentially a "social contract" designed to assign an electronic ID to every human being on earth that will be linked to health records, bank accounts, and all online activity. Through permanent technical surveillance powered by artificial intelligence, the global elite will constantly monitor and control individuals' "social credit," possessing the power to dictate every aspect of daily life. It is already happening in China. Still, despite having access to the wealthiest decision-makers in the world (global enterprises with over five billion dollars in turnover who trek to Davos every year), a fundamental element of Schwab's plan for the Great Reset was missing—an opportunity that would make sense to the masses.

Screenshot / Telegram / https://t.me/DrTenpenny / Screenshot taken following the suspension of Dr. Sherri Tenpenny's account on Twitter. Dr. Tenpenny is widely regarded as the most knowledgeable and outspoken physician on the adverse impact that vaccines can have on health.

Screenshot / Telegram / https://t.me/DrTenpenny / Screenshot taken following the suspension of Dr. Sherri Tenpenny's account on Twitter. Dr. Tenpenny is widely regarded as the most knowledgeable and outspoken physician on the adverse impact that vaccines can have on health.

On Oct. 18, 2019, the WEF, the Bill and Melinda Gates Foundation, and Johns Hopkins Center for Health Security hosted Event 201: A Global Pandemic Exercise. Less than three months later, the coronavirus pandemic gripped humanity, bringing to life most of the scenarios in October's training exercise, including a serious public health crisis, social unrest, government lockdowns, unemployment, fake news, the censorship of free speech, public debt, a sharp economic downturn, global economic shutdowns, and the instability of human well-being.

Suddenly, every facet of society was told they had no choice but to stay at home, conduct business online, and wait for further instructions. And the technocrats had found their opportunity. Seizing the moment, Schwab swiftly declared that the global response to the pandemic proved a Great Reset of our economic and social foundation was within reach. In the nick of time, the COVID-19 crisis supplied a pretext and a justification for continuous surveillance and social controls that cripple all aspects of freedom and personal choice. Without hesitation, in early June 2020, Schwab, along with Prince Charles, IMF Chief Kristalina Georgieva, and the CEOs of BP, Mastercard, and Microsoft announced:

"The pandemic represents a rare but narrow window of opportunity to reflect, reimagine, and reset our world. To achieve a better outcome, the world must act jointly and swiftly to revamp all aspects of our societies and economies, from education to social contracts and working conditions. Every country, from the United States to China, must participate, and every industry, from oil and gas to tech, must be transformed. In short, we need a "Great Reset" of capitalism."

In addition to laying the groundwork for the Great Reset—or as Biden calls it, “Build Back Better”—the pandemic was instrumental in ensuring President Trump's removal from the White House. After all, Trump was a considerable obstacle to their project. In fact, Democratic megadonor George Soros declared at the 2020 WEF that Trump was a “conman and the ultimate narcissist” who had breached the limits of the U.S. constitution and had to be stopped at all costs. Following the questionable results of the Nov. 3 election, as expected, the Biden administration and other world leaders dutifully got in line with the WEF script. And the Great Reset was underway.

A Closer Look at the "Great Reset" and the Fourth Industrial Revolution

In the grandiose propaganda campaign to talk up his dystopian agenda, Schwab defines three main parts of the Great Reset, which is basically an updated version of the long-planned New World Order—or The Global Goals initiated by the UN—revamped to fully integrate artificial intelligence, technical surveillance, and data collection that will ultimately lead to complete digital enslavement.

The Three Parts of The Great Reset

The goal of part one is to "steer the market toward fairer outcomes" with governments implementing "long-overdue reforms that promote more equitable outcomes." Resembling communism, this strategy and the choice of words is disturbing, especially for a nation such as the United States, which is founded on opportunity, not outcomes.

The goal of part two is to "ensure that investments advance shared goals, such as equality and sustainability." Undoubtedly, this equates to equal outcomes, not equal opportunities. Schwab explains that "the large-scale spending programs that many governments are implementing represent a major opportunity for progress. This means, for example, building "green" urban infrastructure and creating incentives for industries to improve their track record on environmental, social, and governance (ESG) metrics."

The goal of part three is to "harness the innovations of the Fourth Industrial Revolution to support the public good, especially by addressing health and social challenges." Explaining further that "during the COVID-19 crisis, companies, universities, and others have joined forces to develop diagnostics, therapeutics, and vaccines; establish testing centers; create mechanisms for tracing infections; and deliver telemedicine." Schwab continued, "Imagine what could be possible if similar concerted efforts were made in every sector."

What is the Fourth Industrial Revolution?

Further inspection of the Fourth Industrial Revolution reveals that every facet of routine daily life will be digitally tracked and therefore vulnerable to compromised cybersecurity. Despite these eye-opening and in-your-face concerns, Schwab and the others are desperately trying to sell their plan as a holistic and well-intended progression humanity must make for the greater good of the earth that is in peace with nature.

Instead, with absolutely nothing natural or holistic about it, the Fourth Industrial Revolution centers squarely around the Internet of Things (IoT), Artificial Intelligence (AI), 5G communications, cloud computing, machine learning, improved algorithms, open-source software, real-time optimization, and other advanced technologies. Essentially, it fuses together digital, physical, and biological systems, altogether blurring the lines between physical and digital realities. As Schwab explains, "it doesn't change what we are doing, but it changes us."

And the lightning-fast speed we are told we need from 5G is just the beginning. Accelerated by the pandemic, the rollout of 5G is still underway around the world, but yet the race for 6G has already begun. On Nov. 11, 2020, the WEF reported (in French only) that China just launched the world's first experimental 6G satellite into orbit. They explain this technology "should offer a speed multiplied by 100 compared to 5G and allow lossless communications in space."

The report on China's testing of 6G technology notes that "where 5G uses millimeter frequencies up to 30 gigahertz, this new generation of communications moves into the terahertz frequency band." The report states the innovative satellite is also carrying optical sensors to provide images taken in orbit and monitor natural disasters such as forest fires and floods or to observe crops and water resources (the Biden administration recently cut water supplies to farmers in CA). Developed by Samsung, the satellite won't be operational until 2028. In what sounds like science fiction, the report asserts:

"This next mobile standard should allow new applications in mixed reality, which mixes virtual and augmented reality, as well as the use of volumetric holograms."

Akyildiz, Ian & Kak, Ahan & Nie, Shuai. (2020). 6G and Beyond: The Future of Wireless Communications Systems. IEEE Access. PP. 1-1. 10.1109/ACCESS.2020.3010896.

Akyildiz, Ian & Kak, Ahan & Nie, Shuai. (2020). 6G and Beyond: The Future of Wireless Communications Systems. IEEE Access. PP. 1-1. 10.1109/ACCESS.2020.3010896.

As technology advances, an outline on the WEF "Strategic Intelligence" webpage from Jun. 9, 2021, paints a picture of what life will be like by 2030. Cooperating with the WEF to achieve its vision for 2030 are partners like Amazon Web Services, Facebook, Google, Microsoft (who each report money manager BlackRock as its number one or number two shareholder), PwC, Huawei, the UN, and Bloomberg. Besides things like autonomous mobility and mining data as the "new oil" (from large-scale IoT deployments), the paper describes:

By 2030, everything that can be connected will be connected, enabled by the deployment of billions of IoT devices. Wearables like smartwatches and glasses will be augmented with new seamlessly integrated devices (e.g., in clothes or implanted as skin patches and bio-implants) to usher in smart living. At the societal level, jobs, entertainment, and public services in smart connected cities will rely on advanced human enhancement technologies.

Advances on wireless brain-computer interactions and augmented/virtual/mixed reality (XR) will revolutionize the way we manipulate and interact with our surroundings. Towards the 6G era, all human senses are expected to interact with machines through Internet of Senses, i.e., haptic interaction with sensory or perceptive feedback. This is key to enable truly immersive steering and control in remote environments.

Cyber Polygon Warns of Future Cyberattacks

Needless to say, advancing technologies are the focus of the future. So, it makes sense that, in a crystal ball moment similar to Event 201, on July 9, 2020, the WEF and INTERPOL hosted a cybersecurity event called Cyber Polygon, with the central theme of preventing a 'digital pandemic' that could span the globe. Last year's event focused on the global digital transformation created by the COVID-19 pandemic and how cybercriminals are exploiting the instability it provides. In the first quarter of 2020, WEF partner Palo Alto Networks (whose top two shareholders are Vanguard and Blackrock) detected a 569% growth in COVID-19-themed malicious registrations, including malware and phishing.

This year's Cyber Polygon takes place on July 9. Teams will practice deflecting a "targeted supply chain attack on a corporate ecosystem." The exercise underscores the rapid spread of the Internet and smart devices, emphasizing that "a single vulnerable link is enough to bring down the entire system, just like the domino effect." With global reliance on "just in time" manufacturing, panic would surely ensue. The event makes sure to point out that the pandemic "is opening truly unlimited opportunities for humanity, but, likewise, cybercriminals benefit from technology and universal interconnectivity." Earlier this year, the WEF issued another warning:

"A cyber attack with COVID-like characteristics would spread faster and farther than any biological virus. Its reproductive rate would be around 10 times greater than what we've experienced with the coronavirus."

The Build-Up to and the Cyberattack on SolarWinds

With the predictions of Cyber Polygon 2020 not yet reaching disaster level, the coronavirus pandemic continued to hold society hostage as 2020 was coming to a close. Suddenly, in mid-Dec. 2020, a virus of a different nature—in the form of a previously undetected global cyberespionage campaign—unveiled itself to help usher in 2021. In either late 2019 or early 2020, quietly kicking off the previously forecast cyber pandemic, the clearly strategic decision to target software developer SolarWinds materialized, when at least one group of hackers inserted malware into a network software product supplied by the company.

For months, attackers quietly infiltrated governments and businesses that used the software through a Trojan horse-style update to SolarWinds' Orion cybersecurity management software. Once downloaded, the virus executed commands that created a backdoor in the network to transfer files, disable services, and reboot machines. Given the absolute scale of the attack and SolarWind's vast U.S. and global clientele in the public, private, and nonprofit sectors, the supply chain attack, finally detected in Dec. 2020, may end up being the most daring cyberespionage campaign in history. By taking aim at the routine software update, it is undoubtedly the most intimate.

SEC filings show SolarWinds has over 300,000 customers worldwide. Approximately 18,000 of them received the software update, with at least 250 networks attacked by the infected file. Government institutions targeted by the attack include the U.S. departments of Defense, Justice, Homeland Security, State, Energy, and the Treasury, as well as all five branches of the U.S. military, the CDC, and the National Nuclear Security Administration. Government agencies and private companies are still trying to determine if the network breach led to any loss of data.

Biden immediately blamed President Trump's "failed attempt to prioritize cyberattacks" for the breach, which also affected many Fortune 500 companies, including Microsoft, Cisco, Equifax, Credit Suisse, PwC, Harvard, Blue Cross Blue Shield, The Gates Foundation, and MasterCard. Notably, the majority of those companies hit in the SolarWinds attack list money manager BlackRock (BLK) (and Vanguard) as either their number one or number two shareholder.

In the months leading up to the SolarWinds attack, there were early warning signs of a problem at SolarWinds. In July, a cybersecurity company called Volexity spotted suspicious activity on a client's computer and thought it might result from a bad update with SolarWinds. They addressed the problem and moved on. Three months later, WEF partner Palo Alto Networks (strategically aligned with Google Cloud, whose top shareholders are Vanguard and BlackRock) discovered a malicious backdoor that seemed to originate from SolarWind's Orion software. Security teams at Palo Alto (whose largest investors are also Blackrock and Vanguard) and SolarWinds worked together for three months to trace the problem. Still, despite Palo Alto's highly coveted Cyber Threat Alliance team, none of the experts detected malware, and they ended their search.

Microsoft / Timeline of the protracted Solorigate (SUNBURST) attack

Microsoft / Timeline of the protracted Solorigate (SUNBURST) attack

Then, on Dec. 8, 2020, cybersecurity threat and intelligence provider FireEye, also a SolarWinds customer, reported that a "state-sponsored, highly sophisticated threat actor" had broken into its network. Immediately following the discovery of the attack against his firm, FireEye CEO Kevin Mandia stated:

"This attack is different from the tens of thousands of incidents we have responded to throughout the years. The attackers tailored their world-class capabilities specifically to target and attack FireEye. They are highly trained in operational security and executed with discipline and focus. They operated clandestinely, using methods that counter security tools and forensic examination. They used a novel combination of techniques not witnessed by us or our partners in the past."

Three days later, on Dec. 11, while conducting breach investigations, FireEye discovered that SolarWinds had been the victim of a supply chain hack. Attackers had corrupted and weaponized SolarWinds Orion Platform software updates to distribute malware that corrupted all of the updates made between March and June 2020. Before letting SolarWinds know of its discovery, FireEye first coordinated with the FBI "and other key partners including Microsoft" and then alerted SolarWinds to their discovery on Dec. 12. The news prompted the National Security Council (NSC) to hold an emergency White House meeting to discuss the security breach of the affected government agencies and enterprises.

FireEye quickly identified a "killswitch," preventing the malware, dubbed Sunburst, from operating, but pointed out it won't remove intruders from systems where they've created other ways of remotely accessing hacked networks. SolarWinds claimed entry was gained through its "already compromised" Microsoft 365 account. However, Microsoft reported it found no evidence the attack occurred through Office 365. Keeping with the pattern, Microsoft's top investors are also Vanguard and BlackRock.

Within hours of discovering the attack, U.S. government officials and cybersecurity experts singled out Russia's Foreign Intelligence Service (known as the SVR) as the conceivable offender. The Russian Embassy in D.C. denied responsibility, claiming the attacks were opposed to Russian foreign-policy interests. Nonetheless, the very nature of the attack makes it impossible to be sure. Confusing the situation even further, another piece of malware targeting SolarWinds at the same time as Sunburst—named Supernova by Palo Alto Network's Unit 42—was apparently planted by an entirely different actor.

Still navigating through the extraordinary predicament handed to him by the COVID-19 pandemic, some wonder if President Trump might have been aware of the plausible narrative and intended outcome of the SolarWinds attack—which affords the opportunity to completely reset cybersecurity on a global scale—and instead quipped of potential Chinese involvement, claiming the “Fake News Media” exaggerated the breach. In a series of tweets, Trump wrote of the hack:

"The Cyber Hack is far greater in the Fake News Media than in actuality. I have been fully briefed and everything is well under control. Russia, Russia, Russia is the priority chant when anything happens because Lamestream is, for mostly financial reasons, petrified of...discussing the possibility that it may be China (it may!). There could also have been a hit on our ridiculous voting machines during the election, which is now obvious that I won big, making it an even more corrupted embarrassment for the USA."

SolarWinds Deploys CrowdStrike Following Attack

The rush to pin the SolarWinds hack on Russia is reminiscent of the narrative immediately following the 2016 election, when Russians were blamed for hacking the servers of the Democrat National Committee (DNC), and then releasing damaging emails to WikiLeaks. According to reports, private, and controversial, cybersecurity firm CrowdStrike first accused Russia of the DNC hack, then for years served as a decisive source for U.S. intelligence officials in the exhaustive Trump-Russia probe. Over two years ago, CrowdStrike admitted to Congress that it had no tangible evidence that Russian hackers were to blame. Last June, the company released a blog update to "set the record straight." Curiously, SolarWinds—whose majority owners sold $286 million of stock just before announcing a new CEO and disclosing the cyberattack—immediately deployed CrowdStrike to analyze and secure its networks following the massive breach.

The long-term ramifications of the SolarWinds hack are about as clear as the motive ultimately behind the attack, with estimates in "hundreds of billions of dollars" to resolve. SolarWinds stock quickly dropped by nearly 25 percent. The holdings of its private equity backers fell by about $1 billion in value, and its credit rating is currently under review by Moody's. Meanwhile, Palo Alto Networks stock has risen following the high-profile hacks. Without having all the answers, one thing is clear, by particularly endangering powerful governments and businesses—including numerous successful technology companies—the SolarWinds exploit completely destroys the concept of information security and wreaks havoc in private equity's most lucrative market.

Next Up, The Colonial Pipeline, JBS, And Other Ransomware Attacks

Following the SolarWinds hack, with the dire messages on climate change picking up speed, Colonial Pipeline, the most extensive pipeline system in the U.S.—carrying 45 percent of the fuel consumed on the East Coast—was the victim of a ransomware attack. The May 7th attack prompted the pipeline, owned in part by Koch Industries, to shut down for five days and resulted in panic-driven fuel shortages along its path.

Other than Energy Secretary Jennifer Granholm's comment to reporters that if you drive an electric car, fuel shortages "would not be affecting you, clearly," the Biden administration had "no comment" during the extensive disruption, which came to an end after the company paid hackers $4.4 million ransom. On June 7, the Department of Justice announced that $2.3 million paid to "Ransomware Extortionists Darkside" had been seized.

Joseph Blount, Colonial Pipeline's president, and CEO, attended a Senate committee hearing on Infrastructure Protection and Cybersecurity on June 9, along with FireEye Mandiant SVP and CTO Charles Carmakal. Blount testified that the Federal government needs to put pressure on the host countries of ransomware actors on behalf of private industry. The committee met again on June 15 to discuss the government's response to the Colonial Pipeline attack, concluding that now is the time to act against the rapidly growing and "unprecedented risk from malicious cyber activities undertaken by both nation-state adversaries and criminals."

Less than a month after the pipeline attack, on May 31, Brazil's JBS SA, the top meat producer globally and in the U.S., was the victim of a ransomware attack which forced the shutdown of all JBS beef processing plants in the country and wiped out production of almost a quarter of American supplies. FireEye CEO Kevin Mandia said ransomware was an "intolerable situation" amid the JBS SA breach.

The JBS SA attack followed a recent warning in The Lancet from climate scientists, shared by Bill Gates and the WEF, asking humanity to "declare a timeframe for peak livestock"—the point at which meat production would begin to decline. Still, demand for beef in countries like China continues to grow unabated. Importantly, an environmentally conscious approach for farming and livestock (in addition to buying locally) is a process called regenerative agriculture. With this approach—unlike Bill Gates solution calling for farmers to produce genetically modified corn and soybeans on every acre—farming and grazing practices using regenerative agriculture actually reverse climate change by rebuilding the organic matter in soil and restoring our currently degraded soil biodiversity—resulting in both carbon drawdown and improvement in the water cycle.

Both the JBS SA and Colonial Pipeline breaches, which attacked industries essential to everyday life in the U.S, were different from the SolarWinds cyberattack in that they used ransomware to extort payouts. The hacker group DarkSide, behind the Colonial Pipeline attack (designated as one of the most expensive attacks on an economy by the WEF), received a staggering $90 million in Bitcoin ransom payments over the last nine months from 47 distinctive wallets.

The Biden administration and the FBI blamed entities from Russia (not the Russian government) for the ransomware attacks. FBI Director Christopher Wray—who spoke virtually at the WEF's annual meeting, Cybersecurity 2020: Enabling the Great Reset—compared the challenges posed by ransomware attacks to the terrorism level of 9/11, calling for a similar response. At the same time, Commerce Secretary Gina Raimondo declared that cyberattacks like the one that hit the Colonial pipeline are "here to stay, and if anything, will intensify." Referencing Biden's sweeping infrastructure agenda, she added:

"It is clear that the private sector needs to be more vigilant ... including small- and medium-sized companies. And also, President Biden has been clear that we are going to do more. Businesses know how to do this. It's relatively inexpensive to do the simpler things like two-factor authentication. At the moment we're going to ... pursue that versus ... a little bit more heavy-handed approach."

A Closer Look At FireEye And Its Split From Mandiant Solutions

FireEye, whose partners include Amazon Web Services and Microsoft (both reporting BlackRock and Vanguard as their number top shareholders), lists the U.S. government as one of its clients. Interestingly, like Amazon and Microsoft (and many other companies mentioned in this article), FireEye's top shareholders are Vanguard and BlackRock.

FireEye CEO Mandia recently pointed out that during times of crisis like the COVID-19 pandemic, hackers take advantage of upheaval and disorder while looking for potential financial gain. Mandia, who sat on the panel of experts in the Senate Intelligence Committee hearing on Russian interference in the 2016 election (specifically to speak about the group referred to as APT28), indicated he believes the SolarWinds breach will not be an isolated incident but added that it's with ransomware attacks—that take less time to pull off and are happening more frequently—that organizations are the most vulnerable. Ransomware-prone institutions like hospitals and governments, according to Mandia, need definitive preventative measures in place, adding, "Pharmaceuticals, hospitals, healthcare, public companies, organizations that don't have the talent and skills to defend themselves—they're getting sucker-punched."

Indeed, with the onset of the COVID-19 crisis in 2020, ninety-two individual ransomware attacks affected over 600 separate clinics, hospitals, organizations, and more than 18 million patient records. According to Johnson & Johnson, it experiences around 15.5 billion cybersecurity incidents every day. The cost of these attacks is almost $21 billion.

In early June 2021, FireEye announced it would sell its products business, including the FireEye name, to a consortium led by private equity firm Symphony Technology Group (STG) for $1.2 billion in cash. Expected to close by the end of the fourth quarter, the deal will separate FireEye's network, email, and cloud security (FireEye helped the federal agencies move to the cloud) products from its cyber forensics unit, Mandiant Solutions. Mandiant (named after Mandia) will return as an independent company focused on cyber-incident response and cybersecurity testing and will be publicly traded following the deal. Mandia noted that the acquisition "unlocks" Mandiant and allows it to partner with outside firms such as Microsoft (who just reported SolarWinds hacking group breached three new victims) adding, "We want to be known as unvarnished truth. There is no bias."

FireEye and the CIA

FireEye was under scrutiny in 2014 when millions of credit card numbers were stolen from Target. At the time, reports circulated that FireEye discovered the attack prior to Target and then provided assistance to the CIA. Additionally, media coverage following Target's breach stated the CIA was one of the founders of FireEye, a claim which FireEye said went out of their way to deny, despite a 2009 article confirming the strategic partnership. T.J. Rylander, a partner at In-Q-Tel—which was created by the CIA in 1999 with $28 million in venture capital—is quoted in the article, saying “FireEye is a critical addition to our strategic investment portfolio for security technologies…and its approach to detecting and defeating malware is unique and potentially game-changing.”

Biden's Move to Zero Trust

Following the recent cyberattacks, on May 12, 2021, Biden signed an Executive Order outlining the steps his administration will take to keep pace with "today’s dynamic and increasingly sophisticated cyber threat environment." The measure calls for extensive plans to "modernize federal government cybersecurity" with the implementation of zero trust—which assumes that there are attackers both within and outside of the network, so no users or machines should be automatically trusted. The ramifications of that assumption are endless.

The move, which includes new mandates for how departments must deploy security technologies such as multi-factor authentication, will require the U.S. government and its suppliers to undergo massive, and profitable, change, with implications also for the private sector. A senior Biden administration official who briefed reporters before the executive order's release explained:

“So today’s executive order makes a down payment towards modernizing our cyber defenses and safeguarding many of the services on which we rely. It reflects a fundamental shift in our mindset—from incident response to prevention, from talking about security to doing security—setting aggressive but achievable goals to make the federal government a leader in cybersecurity, and improve software security and incident response.”

A Closer Look at the Monster That Is BlackRock

Mentioned previously throughout this article, but yet unheard of by many, BlackRock Inc.—a WEF partner, involved in at least five key WEF platforms supporting Klaus Schwab's Great Reset—was founded in 1988. The multinational private equity firm is the world's largest asset manager and "shadow bank," controlling a whopping $9 trillion of other people's money. The span of BlackRock's platforms reaches every corner of the global financial market, with shares and voting rights in many of the biggest international companies in key sectors, such as oil and gas, energy, technology, media, transportation, health, food, and finance.

Promoting itself as a Wall Street good guy, a deeper look at BlackRock—which has been called "the fourth branch of government" and "almost a shadow government,"—reveals a frighteningly powerful international company riddled with conflicts of interest, who, through CEO Larry Fink's lobbying and campaign donations, own friends on both sides of the aisle in D.C., therefore avoiding the kind of regulatory scrutiny a firm its size would and should normally experience.

BlackRock's Sinister Rescue of 2008-09 Financial Crisis

An even closer look at BlackRock uncovers that during the global financial crisis in 2008-09, the company leveraged its insider access to government decision-makers for its own gain. Prior to the crash, in the 1990s and 2000s, Fink grew BlackRock's fortune by supporting the mortgage-back securities (MBS) that eventually crashed the economy in 2008. Following the crash, the Federal Reserve appointed BlackRock to oversee the Maiden Lane facilities used to buy "toxic" assets (unmarketable MBS) from Bear Stearns and AIG, an action the central bank was not legally permitted to perform. Thus, BlackRock made millions cleaning up its own mess. At the time, Senator Chuck Grassley realized the need for scrutiny when he stated:

"[BlackRock has] access to information when the Federal Reserve will try to sell securities, and what price they will accept. And they have intricate financial relations with people across the globe. The potential for a conflict of interest is great and it is just very difficult to police."

Statistics about the ownership of the Big Three in listed US firms. Fichtner, Heemskerk & Garcia-Bernardo (2017)

Statistics about the ownership of the Big Three in listed US firms. Fichtner, Heemskerk & Garcia-Bernardo (2017)

Making Trillions Selling EFTs

While clearly hitting the gold mine with the financial crisis, BlackRock made its real fortunes in exchange-traded funds (EFTs), gaining billions in investable assets after acquiring the iShares series of EFTs in 2009 following a takeover of Barclays Global Investors. By 2020, with over 800 funds, the series was managing over $1.9 trillion in assets. EFTs, which are highly concentrated and fast-growing, control close to half of all investments in US stocks.

Just three U.S. asset managers dominate this sector, holding almost 90 percent of S&P firms, including Microsoft, Apple, ExxonMobil, Coca-Cola, and General Electric, with BlackRock the overwhelming global leader.

BlackRock Suggests Unprecedented Response Needed in Financial Markets

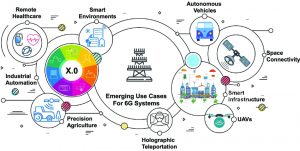

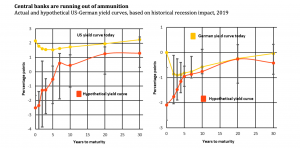

In a case of fortune-telling similar to the clues before the coronavirus pandemic and recent cyberattacks (and arguably setting up part one and part two of the Great Reset), in August 2019—with the pandemic still four months away—BlackRock Vice-Chair Philipp Hildebrand, former president of Swiss National Bank, along with other BlackRock executives, hinted of a looming financial crisis when presenting a proposal to the meeting of central bankers, pitching the need of a "bold plan for addressing what appears to be the end of the line for conventional monetary policy."

The proposal, basically calling for an economic reset, was published ahead of the Kansas City Fed's Economic Policy Symposium in Jackson Hole, Wyoming in late August 2019. It advocated for "more explicit coordination between central banks and governments when economies are in a recession so that monetary and fiscal policy can better work in synergy." Hildebrand, declaring that central bankers were running out of ammunition for regulating the economy and the supply of money, stated at the time:

"Really, there is little if any ammunition left. More of the same in terms of monetary policy is unlikely to be an appropriate response if we get into a recession or sharp downturn.”

To remedy the financial downturn, BlackRock advised that "an unprecedented response is needed when monetary policy is exhausted and fiscal space is limited. Thus, they suggest "going direct" with so-called helicopter money. However, in order to get a helicopter-drop style policy, the responses of the government and the independent central bank would first need to be coordinated. In theory, this doesn’t present much of a barrier, in practice the two seldom operate seamlessly with one another and indeed frequently operate in disagreement.

Sources: BlackRock Investment Institute, with data from Refinitiv Datastream, August 2019. Notes: The chart shows the current US Treasury and German bond yield curves and hypothetical yield curves. The hypothetical curves show what the yield curve would look like based on the curve’s median move during the past five recessions. The bars show the range of moves during those recessions. To account for the changing interest rate environment of the past few decades, the curve moves are adjusted based on the structural decline in neutral rates discussed on this page. Forward-looking estimates may not come to pass.

Sources: BlackRock Investment Institute, with data from Refinitiv Datastream, August 2019. Notes: The chart shows the current US Treasury and German bond yield curves and hypothetical yield curves. The hypothetical curves show what the yield curve would look like based on the curve’s median move during the past five recessions. The bars show the range of moves during those recessions. To account for the changing interest rate environment of the past few decades, the curve moves are adjusted based on the structural decline in neutral rates discussed on this page. Forward-looking estimates may not come to pass.

BlackRock Investment Institute / Aug 15, 2019 / Setting the Scene: There is not enough monetary policy space to deal with the next downturn. A soft form of coordination would help ensure that monetary and fiscal policy are both providing stimulus rather than working in opposite directions, as has been the case in the post-crisis period, suggesting room for improved policy - yet simply hoping for that to happen is not enough. An unprecedented response is needed.

BlackRock Investment Institute / Aug 15, 2019 / Setting the Scene: There is not enough monetary policy space to deal with the next downturn. A soft form of coordination would help ensure that monetary and fiscal policy are both providing stimulus rather than working in opposite directions, as has been the case in the post-crisis period, suggesting room for improved policy - yet simply hoping for that to happen is not enough. An unprecedented response is needed.

New York Fed Retains BlackRock to Manage COVID-19 Bailout

Fast forward to March 2020, and, thanks to the COVID-19 pandemic, a record 3.3 million Americans had filed unemployment claims, and the national lockdown left states, cities, and local businesses in desperate need of federal aid. The country (and world) was in a furious financial meltdown and needed a bailout. In a move that echoes its pivotal role in 2008, BlackRock CEO Larry Fink got to work. Recently released emails obtained by the NY Times revealed that over the weekend leading up to the public unveiling of their plan, U.S. economic policymakers conspired repeatedly with Fink. Both Federal Reserve Chair Jerome H. Powell and Treasury Secretary Steven Mnuchin spoke with Fink a total of fourteen times, with Mnuchin conducting sixty calls on the matter.

Source: Treasury Department published calendars

Source: Treasury Department published calendars

By The New York Times

Following the frenzied weekend, on Tues., Mar. 24, the Federal Reserve Bank of New York (FRBNY) announced it had retained BlackRock to take charge, awarding the company a no-bid contract under the CARES Act to be the sole buyer of corporate bonds and corporate bond EFTs for the Fed's unprecedented $750 billion corporate bond program, which included both investment grade and junk-rated bonds. The selling point was BlackRock's prior experience in 2008-09 with Maiden Lane facilities, along with its massive proprietary risk-management platform called Aladdin, which manages over $21 trillion in assets.

Under terms of the Federal bailout, BlackRock was allowed to buy its own corporate bond EFTs to prop up the corporate bond market. Turns out, these EFTs are at the heart of the COVID-19 crisis and needed a bailout. So, BlackRock used its unique position with the government to make it happen. In fact, the only purchases made under the BlackRock-administered purchases as of May 30, 2020, were ETFs, and most were owned by BlackRock itself. Institutional Investor reported that the company, on behalf of the Fed, “bought $1.58 billion in investment-grade and high-yield ETFs from May 12 to May 19, with BlackRock’s iShares funds representing 48 percent ($746 million) of the $1.307 billion market value at the end of that period, ETFGI said in a May 30 report.” The Fed continued to buy more ETFs after May 20, and investors joined in, resulting in huge inflows into BlackRock’s corporate bond ETFs.

To make matters even more egregious, the CARES Act set aside $454 billion of taxpayers’ money to absorb the losses in the Fed's bailout programs. Last March, a total of $75 billion had been allocated to eat losses in the corporate bond-buying programs being managed by BlackRock. Since BlackRock was allowed to buy up its own ETFs, taxpayers will cover the losses that might have otherwise accrued to billionaire Larry Fink’s company and investors. As if the blatant monopoly over global finances wasn't enough, BlackRock's conflicts of interest spread much farther.

BlackRock—potentially killing the dream of homeownership for many families—has its hand in the housing market as well, with its massive buying likely driving up prices. Led by Fink, the investment giant is recklessly purchasing entire single-family neighborhoods, reselling them later at higher prices, or converting them into rentals. In some cities, like Houston, these types of investments account for one-quarter of the home purchasers.

BlackRock on Climate Change And A Net Zero Global Economy by 2050

Another likely conflict is BlackRock's mission of "climate innovation,"—the company is committed to achieving a net zero global economy by 2050. To accomplish its goal, BlackRock—who is fueling the $120 trillion transformation on Wall St.—asserts it will require a "complete transformation of the global economy" by replacing fossil fuels with "low carbon sources such as wind and solar." Clearly, in a position to drive the market, the company advises that as policymakers, regulators, and consumers race towards a net zero economy, those not ready to join the movement risk being left behind by consumers and shareholders. Last October, BlackRock reported that a Biden victory, combined with the Democrats taking control of the Senate, would accelerate the shift towards sustainability in the energy sector, including research and development spending (as well as more favorable market conditions in the healthcare and tech sectors). Fink, a longtime Democrat, commented last year that because of global warming, "We are on the edge of a fundamental re-shaping of finance."

BlackRock's Massive China Footprint

In addition to pushing net zero, BlackRock's international leaders are also pushing China, intently clarifying the "increasing economic and geopolitical influence" the country delivers to investors while pointing out that China's rapid recovery from the COVID-19 has been "fast and strong." When describing the opportunities for yield and income in China, BlackRock foretells the CCP will be a top driver of global growth with a market too big to ignore. Asserting that "a bipolar U.S.-China world order" is at the center of a "rewiring of globalization" hurried up by the COVID-19 pandemic, the firm advises:

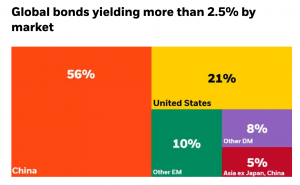

"... Covid-19 triggered a race to near-zero interest rates in developed countries. The U.S. currently has US$17+ trillion worth of bonds with negative yields, which is roughly the size of the entire Chinese bond market, where most bonds yield more than 2.5% are found. We believe the recent strong net inflows validates the attractiveness of Chinese fixed income markets and are indicative of future flows."

Despite the tension between Washington and China, BlackRock's presence in the communist nation is growing. In mid-May, the company received approval from the China Securities Regulatory Commission to operate a wealth management business in mainland China, becoming the first global asset manager to start a wholly-owned mutual fund business in the CCP. The business will be carried out through a joint venture that will be 50.1% owned by BlackRock. China Construction Bank Corp. will have a 40% stake while Singapore state investment firm Temasek Holdings will own the remaining 9.9%. With China expected to soon launch the Wealth Management Connect scheme in the Greater Bay Area—connecting Hong Kong, Macau, and mainland China—many international asset managers believe that at some point in the near future they will be able to start offering non-Chinese products to households in the country.

Sources: BlackRock Investment Institute, with data from Refinitiv, May 2021.

Sources: BlackRock Investment Institute, with data from Refinitiv, May 2021.

Source: BlackRock, Wind, December 2020. Based on the Bloomberg Barclays Multiverse and all eligible China onshore bonds - both rates and credit bonds (>1billion CNY size, > 1-year maturity). DM and EM stand for developed and emerging markets, respectively.

Source: BlackRock, Wind, December 2020. Based on the Bloomberg Barclays Multiverse and all eligible China onshore bonds - both rates and credit bonds (>1billion CNY size, > 1-year maturity). DM and EM stand for developed and emerging markets, respectively.

BlackRock Executives in the Biden Administration

Besides China, other resources that are undoubtedly valuable to BlackRock are former company leaders that now hold prominent roles in the Biden Cabinet (and many served Obama before that). Past global head of sustainable investing at BlackRock, Brian Deese serves as the Director of the National Economic Council (NEC), advising Biden on international economic policy. Wally Adeyemo, a former chief of staff to Fink, now serves as Deputy Secretary to the Treasury. And Michael Pyle, a former law clerk to U.S. Attorney General Merrick Garland and global chief investment strategist at BlackRock, currently serves as chief economic advisor to VP Kamala Harris. Last year, Pyle pitched BlackRock's case for downgrading U.S. equities.

For almost a decade, BlackRock has formed close relationships with governments, allowing them to overshadow competitors and skirt demanding regulatory standards. Since 2004, BlackRock's "extraordinary access to the halls of government power" has enabled the secret world power to hire dozens upon dozens of former government officials, regulators, and central bankers worldwide. In 2018, public corruption watchdog the Campaign for Accountability launched an investigation into BlackRock that is no longer on the Internet in any great detail.

The must-watch video above extends a very accurate overview of modern global systems, providing a detailed and disturbing summary of the unprecedented influence carried by the hidden monopoly network of BlackRock and Vanguard, the corporations they own, and their significant role in the Great Reset.

Common Ownership in the US Pharmaceutical Industry: A Network Analysis. BlackRock, Vanguard, and Fidelity in the top 20 brand firms, 2014.

Common Ownership in the US Pharmaceutical Industry: A Network Analysis. BlackRock, Vanguard, and Fidelity in the top 20 brand firms, 2014.

Is Technology The Final Frontier?

While the mad dash towards the totalitarian "Great Reset" can't be pinned exclusively on the World Economic Forum, the elite group's role here is undeniable. The same holds true for BlackRock, whose clandestine power is truly scary. Non-profits like the Bill and Melinda Gates Foundation appear to cleverly provide cover for the connection between the media, politics, and the few big companies literally running the world. Without a doubt, the principles upon which this great nation was founded are under massive attack. Whether from government-ordered COVID-19 lockdowns, cyberattacks, extreme censorship, forced experimental "vaccines"—even for young children who are of little to no risk of getting or spreading "the virus"—we are desperately seeking truth in a society waging war against honesty. Like the predicted COVID-19 pandemic and the recent cyberattacks, humanity's increasingly powerful technology is promoting a frightening agenda that has the power to imprison us all. We can't let it.