Historic spending on the climate crisis and tax loopholes are the focus of the Inflation Reduction Act of 2022, passed by the House on Wednesday. Essentially a renamed Green New Deal, the bill raises taxes on corporations to close existing loopholes and "represent[s] the single biggest climate investment in U.S. history, by far," according to a summary of the bill published by Business Insider. The Senate will consider the bill next week. If the Senate uses the reconciliation process, it may be able to pass the bill with as few as 50 votes. The bill has been stalled for about a year and would be a huge win for House Democrats if it is passed by the Senate and signed by Biden.

Sen. Joe Manchin initially signaled he would not support a bill with provisions for the climate crisis; however, he brokered a deal anyway with Majority Leader Chuck Schumer on Wednesday. The bill includes in Section 13901 a significant coal tax hike to help fund the black lung disability trust fund.

Manchin stated in a Wednesday press release that he is concerned about the national debt and "inflation that is crushing American workers." To that end, he agreed to the "adoption of a tax policy that protects small businesses and working-class Americans while ensuring that large corporations and the ultra-wealthy pay their fair share in taxes." He also agreed to "strategic and historic investments that allow us to decarbonize while ensuring American energy is affordable, reliable, clean and secure" in an effort to address the "climate crisis" and ensure American energy independence.

Raising Taxes on Some Corporations

The bill includes a proposal to raise "approximately $450 billion to pay for deficit reduction, clean energy, and climate investment." It also increases IRS resources to track and audit corporations that are not paying their fair share. The bill imposes a 15% Corporate Minimum Tax on the top 200 corporations not currently paying taxes at that level. The 15% increase will allegedly raise $313 billion in revenue. The provision will be effective for taxable years after December 31, 2022. Higher corporate tax rates usually eventually result in fewer jobs for Americans.

$80 billion in spending over the next ten years will be spent on "tax enforcement and compliance," allegedly resulting in the collection by the IRS of $203 billion. Taxpayers with taxable income below $400,000 will allegedly not see an increase in their tax bills. Households earning $500k or more pay about 42% of all income taxes. The bill also directs $15,000,000 in funds to the IRS to "prepare and deliver a report to Congress on the cost of developing and running a free direct e-file tax return system." Those funds also permit greater flexibility in direct-hire authority.

The Inflation Reduction Act of 2022/Summary table

The Inflation Reduction Act of 2022/Summary table

Record Level of Climate Change Spending Included in Bill

Approximately $385 billion will go to climate crisis and energy policies. The bill requires a 40% reduction in greenhouse gas emissions by 2030. Depending on household income, Americans could qualify for a $4500 tax credit for purchasing used electric vehicles and $7500 for new vehicles. Tax credits abound for water heaters, rooftop solar energy, and heat pumps. $60 billion will go toward "domestic clean energy." The bill aims to "decarbonize all sectors of the economy" and "focuses investments on the too often left-behind disadvantaged communities."

Consumer energy costs will be addressed with monetary incentives. The bill incentivizes consumers with rebates, tax credits, and grants "to buy energy efficient and electric appliances, clean vehicles, and rooftop-solar, and invest in home energy efficiency, with a significant portion of the funding going to lower-income households and disadvantaged communities."

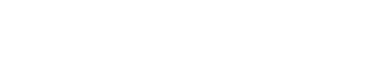

Consumer Incentives

Consumer Incentives

The bill supports "historic investments in American clean energy manufacturing," which usually results in higher costs to consumers and corporations. Nevertheless, the bill states that over $60 billion in manufacturing incentives will help to hedge against inflation and bring down future costs of "clean energy and clean vehicles."

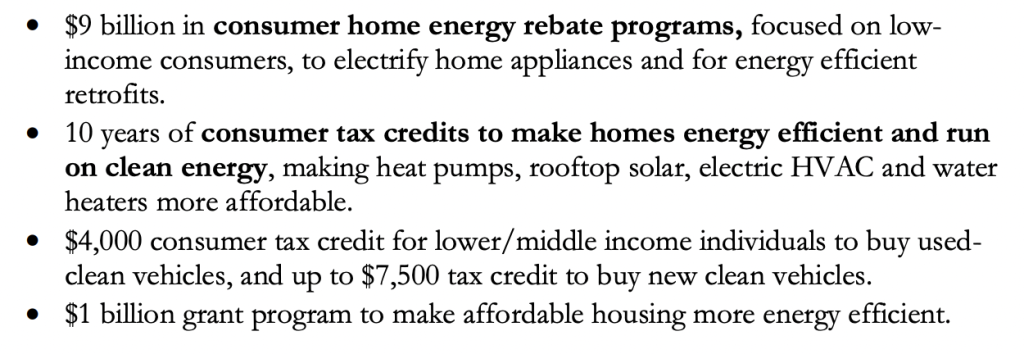

Manufacturing Incentives/Inflation Reduction Act 2022

Manufacturing Incentives/Inflation Reduction Act 2022

Decarbonization

Decarbonizing the economy is a big priority for climate activists, and this bill delivers over $65 billion in grants and tax credits toward that goal. The bill seeks to reduce emissions in multiple sectors; electricity production, transportation, industrial manufacturing, buildings, and agriculture. The proposal also encourages proposals that encourage "diet and feed management strategies to reduce enteric methane gas emissions from 8 ruminants"—(animals like cows and pigs).

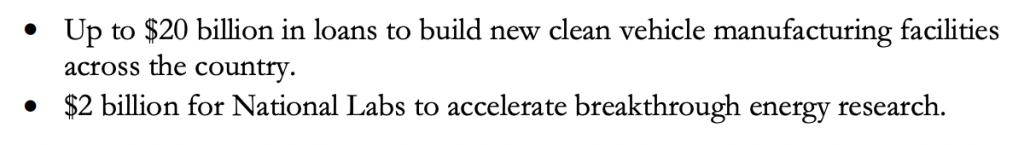

Decarbonization/The Inflation Reduction Act 2022

Decarbonization/The Inflation Reduction Act 2022

Environmental Justice Grants for Disadvantaged Communities

As is usually the case in the current administration, there are over $60 billion in funds dedicated to "disadvantaged" communities and "environmental justice," mainly in the form of grants. Biden issued an Executive Order in January of 2021 on the climate crisis that resulted in a letter on May 5 from the Department of Justice directing United States Attorneys to promote environmental justice enforcement strategies. A recent and ongoing environmental contamination case in Houston is a prime example of how this administration plans to target environmental injustices.

Environmental Justice Grants/The Inflation Reduction Act 2022

Environmental Justice Grants/The Inflation Reduction Act 2022

Rural Communities Get Grants Too

Approximately $30 billion in funds will go to build "resilient rural communities." $20 billion alone will go toward "smart agriculture practices." $5 billion will be spent on fire-resilient forests, forest conservation, and urban tree planting. $2.6 billion will fund the conservation and restoration of coastal habitats. There are also tax credits and grants to "build the infrastructure needed for sustainable aviation fuel and other biofuels." Notably, Hawaii will get at least $23,500,000 in funds through 2031 for Native Hawaiian Climate resilience and adaptation.

Biden Says Inflation Bill is Similar to Build Back Better Bill

In a speech on Thursday, President Biden said that the bill will "lower healthcare costs for millions, restore fairness to the tax code, and take decisive action on the climate crisis." This administration is so worried about the heat it has rolled out an entire website entitled Heat.gov dedicated to "heat-related illnesses and death." Biden also says the legislation will help the U.S. economy.

Concerning healthcare, Biden stated he is delivering "on a promise that Washington has made for decades to the American people" by giving Medicare "the power to negotiate for lower prescription drug prices." By the way, President Trump attempted to lower prescription prices in July of 2020, but his efforts were diminished repeatedly by lawsuits from BigPharma and later blocked by a federal judge in December 2020. Biden also stated the bill will "lock in place lower healthcare premiums for the next three years for millions of families that get coverage under the Affordable Care Act."

President Biden claims "55 of the Fortune 500 companies paid no federal income tax in 2020," with a "collective income of over $40 billion." Please see Tax Myth number 6 for a more nuanced explanation of how corporate federal income taxes shake out. Biden also claims to have reduced the federal deficit by $350 billion in the first year of his administration. Biden reiterated that America is not in a recession because of a "record job market and record unemployment of 3.6 %."

Biden's unemployment numbers may result from statistical wizardry because many Americans may have been out of work so long that they have fallen off the unemployment system. Also, rehiring laid-off people does not mean new jobs. President Obama was famous for fudging unemployment numbers. He also stated his administration is responsible for the "strongest rebound in American manufacturing in over three decades" with the passing of the CHIPS Bill and a $22 billion deal with the SK Corporation of the Republic of South Korea. The CHIPS deal was brokered to bring microchip manufacturing back to the U.S. from China. However, it may amount to nothing more than corporate welfare and it does nothing to prevent China from stealing American intellectual property—a long-standing and material threat to American industry.